Sales Tax Taxes In North Carolina . Due to varying local sales tax rates, we. Tax rates & tax charts our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. It is not intended to cover all provisions of the law or. Historical total general state, local, and transit rate; tax rates effective 7/1/2024; Notice:the information included on this website is to be used only as a guide. 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax of up to 2.75%. the north carolina sales tax handbook provides everything you need to understand the north carolina sales tax as a consumer or. 35 rows sales and use tax rates effective october 1, 2020. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. sales and use tax. Listed below by county are the total (4.75% state rate plus.

from learningdarkvonhack2n.z21.web.core.windows.net

Due to varying local sales tax rates, we. Notice:the information included on this website is to be used only as a guide. 35 rows sales and use tax rates effective october 1, 2020. tax rates effective 7/1/2024; the north carolina sales tax handbook provides everything you need to understand the north carolina sales tax as a consumer or. Listed below by county are the total (4.75% state rate plus. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. sales and use tax. Tax rates & tax charts It is not intended to cover all provisions of the law or.

North Carolina Sales Tax Rates 2023

Sales Tax Taxes In North Carolina 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax of up to 2.75%. 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax of up to 2.75%. It is not intended to cover all provisions of the law or. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. Due to varying local sales tax rates, we. Notice:the information included on this website is to be used only as a guide. Listed below by county are the total (4.75% state rate plus. our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. 35 rows sales and use tax rates effective october 1, 2020. Historical total general state, local, and transit rate; the north carolina sales tax handbook provides everything you need to understand the north carolina sales tax as a consumer or. sales and use tax. Tax rates & tax charts tax rates effective 7/1/2024;

From perfect-free.typepad.com

How should North Carolina slice the tax revenue pie? The Perfect and Sales Tax Taxes In North Carolina tax rates effective 7/1/2024; Historical total general state, local, and transit rate; our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. the north carolina. Sales Tax Taxes In North Carolina.

From ceimizec.blob.core.windows.net

Used Car Sales Tax In North Carolina at Pattie Garrison blog Sales Tax Taxes In North Carolina Notice:the information included on this website is to be used only as a guide. our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. tax rates effective 7/1/2024; 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax. Sales Tax Taxes In North Carolina.

From www.templateroller.com

Form E536 Download Fillable PDF or Fill Online Schedule of County Sales Tax Taxes In North Carolina you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. Historical total general state, local, and transit rate; Notice:the information included on this website is to be used only as a guide. Listed below by county are the total (4.75% state rate plus. sales and. Sales Tax Taxes In North Carolina.

From webinarcare.com

How to Get North Carolina Sales Tax Permit A Comprehensive Guide Sales Tax Taxes In North Carolina Tax rates & tax charts the north carolina sales tax handbook provides everything you need to understand the north carolina sales tax as a consumer or. Notice:the information included on this website is to be used only as a guide. Historical total general state, local, and transit rate; tax rates effective 7/1/2024; 35 rows sales and use. Sales Tax Taxes In North Carolina.

From blog.taxjar.com

How to Register for a Sales Tax Permit in North Carolina?TaxJar Blog Sales Tax Taxes In North Carolina 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax of up to 2.75%. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. the north carolina sales tax handbook provides everything you. Sales Tax Taxes In North Carolina.

From learningdarkvonhack2n.z21.web.core.windows.net

North Carolina Sales Tax Rates 2023 Sales Tax Taxes In North Carolina Tax rates & tax charts sales and use tax. our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. 35 rows sales and use tax. Sales Tax Taxes In North Carolina.

From www.templateroller.com

Form E536 Download Fillable PDF or Fill Online Schedule of County Sales Tax Taxes In North Carolina our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. sales and use tax. the north carolina sales tax handbook provides everything you need to understand the north carolina sales tax as a consumer or. Historical total general state, local, and transit rate; 830 rows north carolina has. Sales Tax Taxes In North Carolina.

From carolinapublicpress.org

New NC sales tax plan would boost 13 WNC counties Carolina Public Press Sales Tax Taxes In North Carolina Notice:the information included on this website is to be used only as a guide. Due to varying local sales tax rates, we. tax rates effective 7/1/2024; Tax rates & tax charts our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. 830 rows north carolina has state sales tax. Sales Tax Taxes In North Carolina.

From www.sales-taxes.com

27514 Sales Tax Rate NC Sales Taxes By ZIP May 2024 Sales Tax Taxes In North Carolina 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax of up to 2.75%. It is not intended to cover all provisions of the law or. sales and use tax. you can use our north carolina sales tax calculator to look up sales tax rates in. Sales Tax Taxes In North Carolina.

From howtostartanllc.com

North Carolina Sales Tax Small Business Guide TRUiC Sales Tax Taxes In North Carolina tax rates effective 7/1/2024; Historical total general state, local, and transit rate; sales and use tax. It is not intended to cover all provisions of the law or. Due to varying local sales tax rates, we. 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax. Sales Tax Taxes In North Carolina.

From printablethereynara.z14.web.core.windows.net

North Carolina Tax Rates 2024 Sales Tax Taxes In North Carolina Historical total general state, local, and transit rate; Listed below by county are the total (4.75% state rate plus. It is not intended to cover all provisions of the law or. Due to varying local sales tax rates, we. Notice:the information included on this website is to be used only as a guide. you can use our north carolina. Sales Tax Taxes In North Carolina.

From quizzdbbackovnc.z13.web.core.windows.net

North Carolina Sales Tax Rates 2024 Sales Tax Taxes In North Carolina Due to varying local sales tax rates, we. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. 35 rows sales and use tax rates effective october 1, 2020. Historical total general state, local, and transit rate; It is not intended to cover all provisions. Sales Tax Taxes In North Carolina.

From studyimbalzano50.z21.web.core.windows.net

North Carolina Sales And Use Tax Rates 2023 Sales Tax Taxes In North Carolina Notice:the information included on this website is to be used only as a guide. the north carolina sales tax handbook provides everything you need to understand the north carolina sales tax as a consumer or. sales and use tax. our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus.. Sales Tax Taxes In North Carolina.

From www.scribd.com

North Carolina Tax Reform Options A Guide To Fair, Simple, ProGrowth Sales Tax Taxes In North Carolina Tax rates & tax charts Historical total general state, local, and transit rate; sales and use tax. you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. Listed below by county are the total (4.75% state rate plus. the north carolina sales tax handbook. Sales Tax Taxes In North Carolina.

From quizzfullclassantstf.z14.web.core.windows.net

North Carolina Sales And Use Tax Rates 2023 Sales Tax Taxes In North Carolina you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. tax rates effective 7/1/2024; Notice:the information included on this website is to be used only as a guide. 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect. Sales Tax Taxes In North Carolina.

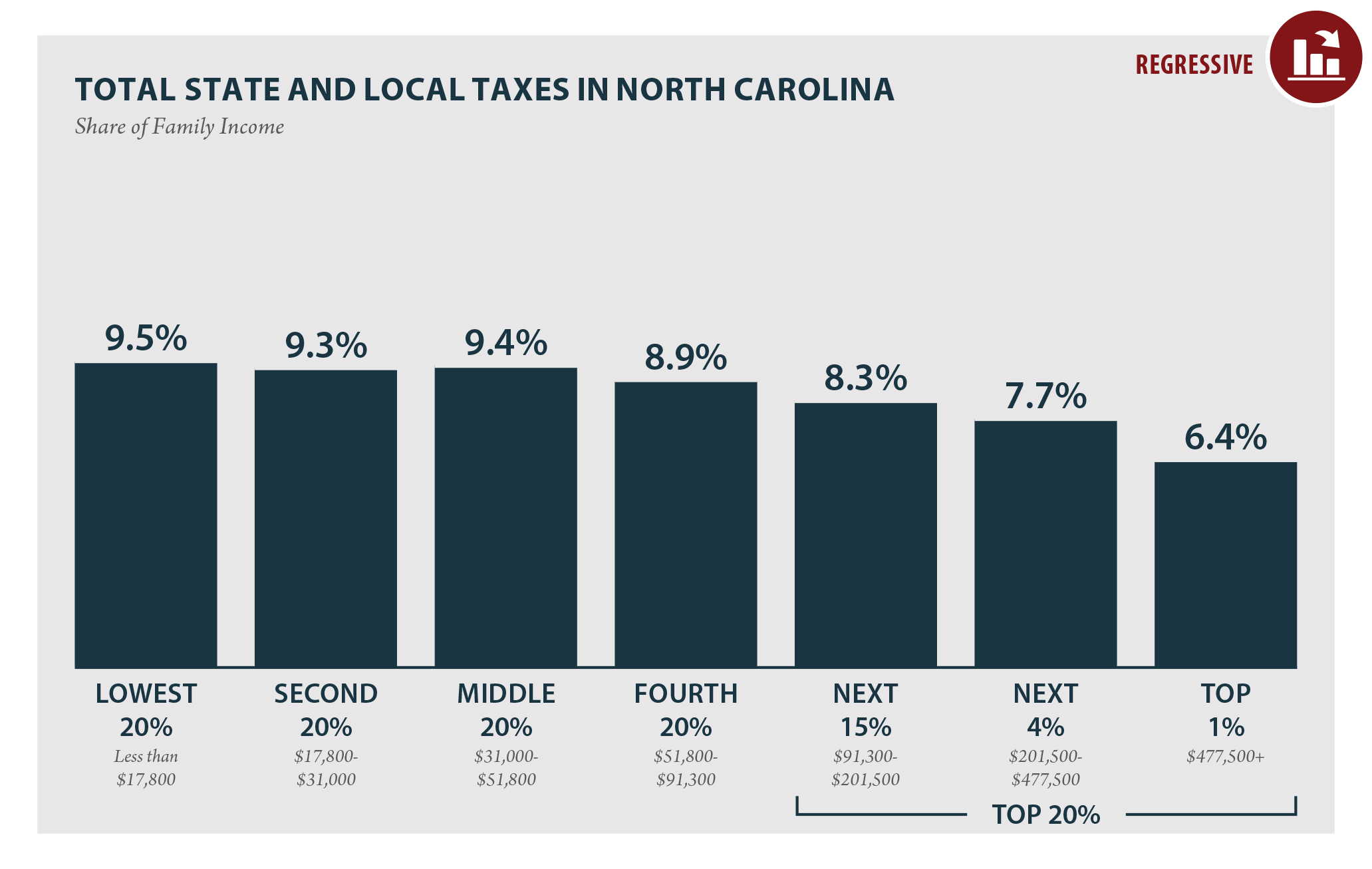

From itep.org

North Carolina Who Pays? 7th Edition ITEP Sales Tax Taxes In North Carolina 35 rows sales and use tax rates effective october 1, 2020. It is not intended to cover all provisions of the law or. Tax rates & tax charts our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. sales and use tax. 830 rows north carolina has state. Sales Tax Taxes In North Carolina.

From www.templateroller.com

Form E536 Download Fillable PDF or Fill Online Schedule of County Sales Tax Taxes In North Carolina tax rates effective 7/1/2024; you can use our north carolina sales tax calculator to look up sales tax rates in north carolina by address / zip code. Notice:the information included on this website is to be used only as a guide. the north carolina sales tax handbook provides everything you need to understand the north carolina sales. Sales Tax Taxes In North Carolina.

From www.templateroller.com

North Carolina County Sales and Use Tax Report Summary Totals and Sales Tax Taxes In North Carolina Listed below by county are the total (4.75% state rate plus. 830 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax of up to 2.75%. our free online guide for business owners covers north carolina sales tax registration, collecting, filing, due dates, nexus. the north carolina. Sales Tax Taxes In North Carolina.